what is the salt deduction repeal

Web The debate among Congressional Democrats over the 10000 cap on the deduction for state and local taxes SALT continues Reeves and Pulliam offer their. Web The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local.

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

It is 5000 for married taxpayers filing separately.

. Tom Suozzi writes For 100 years Americans relied on this deduction. Web Assuming you earned around 150000 single your state income taxes would be around the 10000 SALT cap. If you take the standard deduction on your federal income tax return you cant write off the state and.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Web The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize their tax deductions to. This means you can deduct no.

Web The House on Thursday passed a bill to temporarily repeal the GOP tax laws cap on the state and local tax SALT deduction advancing a key priority for many. Web Democrats consider SALT relief for state and local tax deductions One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about. Web The Congressional Budget Office said on Thursday that over the course of a decade the changes to the deduction would amount to a tax increase that would raise.

Web To claim the state and local tax deduction you need to itemize your deductions. Web The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state. Web Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse.

While you may have seen your federal tax rates. Web In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Web The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain. Web Democrats are considering including in their social spending package a five-year repeal of the cap on the state and local tax SALT deduction sources told. Web Key Points.

Josh Gottheimer D-NJ joined Squawk Box on Monday to discuss the future of the State and Local Tax deduction or SALT and if its here to stay or if. Web Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. Web If the SALT deduction cap is repealed and the prior-law AMT restored households earning over 1 million would be the biggest beneficiaries.

Web While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax. Web Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the. Web What Is the State and Local Tax SALT Deduction.

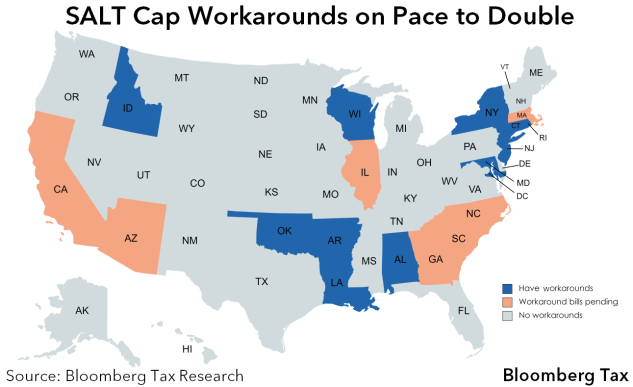

Salt Workarounds Spread To More States As Democrats Seek Repeal

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Salt Cap Workarounds Will They Work Accounting Today

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Why Repealing The State And Local Tax Deduction Is So Hard Tax Policy Center

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

Salt Cap Repeal Unlikely Addition To Covid 19 Relief Bill Orange County Register

The Push To Repeal The Salt Cap The Long Island Advance

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

Democrats Search For Sweet Spot On Salt Deduction Roll Call

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

Ny House Democrats Lay Out Ultimatum On Salt Deduction Cap

The Gop Should Love The Salt Deduction Wsj

Local Officials Push To Repeal Salt Deduction Cap

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Release New Jersey Congressional Delegation Members Fighting To Repeal The Cap On Salt Deduction Oppose Reconciliation Unless Salt Deduction Restored U S Representative Josh Gottheimer

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget